Promotions and News

Beware of Scam Calls

Scheme Participants Webinar "Termination of Guaranteed Funds in the Principal MPF Scheme Series 800, and the Principal MPF - Smart Plan"

Good MPF Employer Award 2023-24 accepts applications till 15 July

Time-limited Offer for MPF consolidation, enjoy up to 0.36% management fee discount

Sustainability Related Documents

Updates of Principal Prosperity Series

Principal Hong Kong Company Profile & Industry Recognition

Tax Deductible Voluntary Contributions

Tax Deductible Voluntary Contributions(TVC) is a new type of contributions under the MPF system. Members…

We personalise for your real life

We protect your future

We plan for your retirement dream

We grow your present investment

We plan for your financial future

We help you protect and save enough

We help you live your best life

We personalise for your real life

We protect your future

We plan for your retirement dream

We grow your present investment

We plan for your financial future

We help you protect and save enough

We help you live your best life

Why Principal Financial Group?

140+

years of experience in financial services

US$695

billion assets under management (Dec 2023)

62

million customers worldwide (Dec 2023)

236

ranking in FORTUNE 500® in 2023

One-of-a-kind asset management

We have a roster of experienced global expertise

Building and managing your portfolio can be daunting; especially without the know-how. Let our professional portfolio managers ease your apprehensions by aiding you to achieve your goals. Building wealth or generating stable income; they have the expertise. Principal Global Investors leads global asset management at Principal, and is ranked 23rd* in the globe.

* Managers ranked by total worldwide assets as of 31 December 2021. “Largest Money Managers,” PENSIONS & INVESTMENTS (December 2021).

Learn More

Our Expertise

With Principal, you can choose from a series of featured services to best fit your needs.

MPF Schemes

ORSO Schemes

Mutual Funds

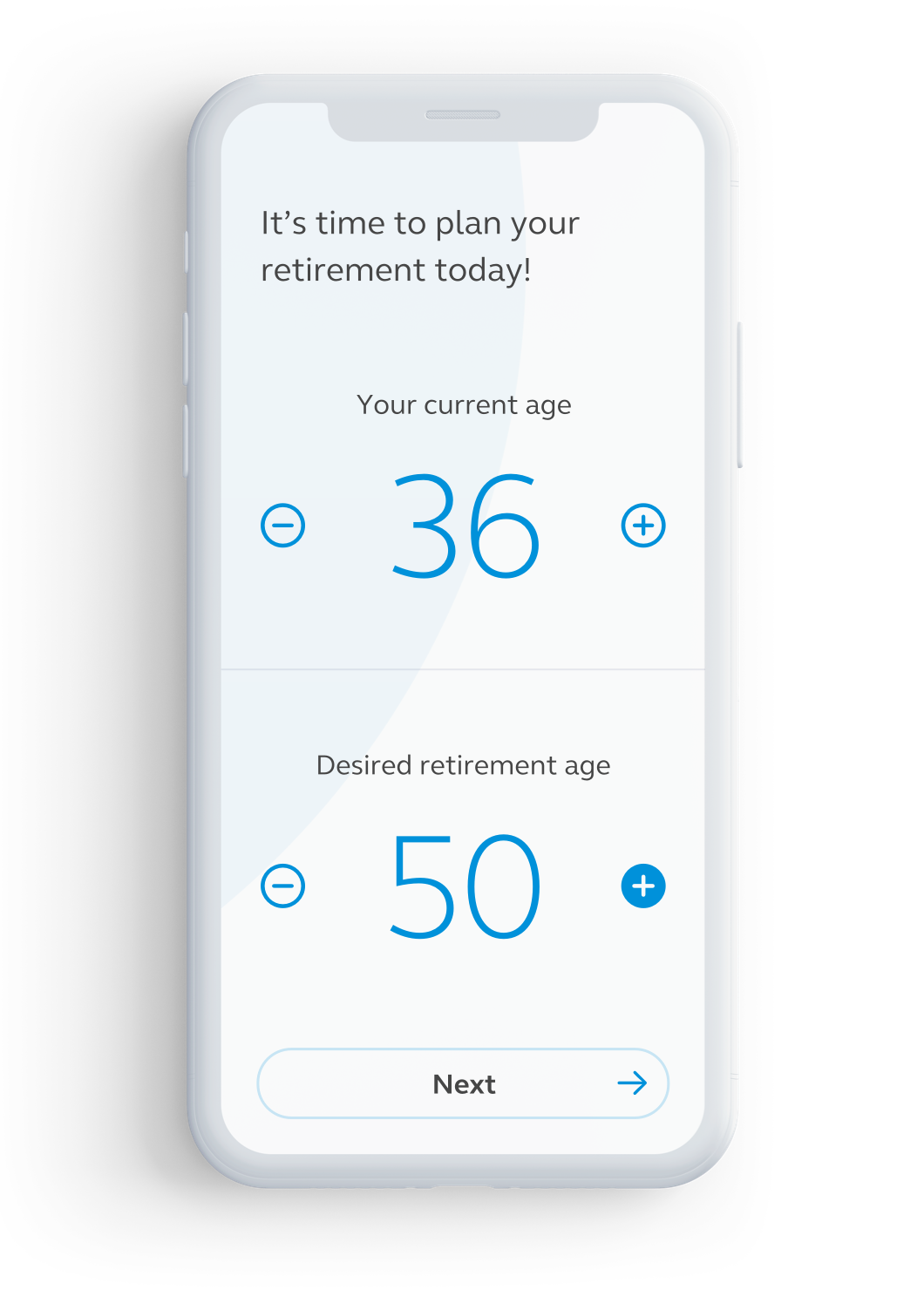

Tailored retirement plan. Just for you.

Use Retirement Calculator

Saving Outcome

Interactive and responsive result with info graphics at a glance

*The above image is an illustration of calculator on mobile website.

Retirement Strategies

Compare different scenarios to better plan your retirement

You’ve got backup

We can guide you each step of the way.

We know choosing the right retirement plan isn’t anyone’s favourite thing to do. Let us know your goals and we will help you plan it, so you can get back to the stuff that really matters.

Pick your status on the right for examples

30s

Meet Magrette

She’s 32, a team lead, single, and earns HKD$30,000 a month. Heard saving for retirement now is beneficial, but unsure which funds to select and how much to put aside.

Tip to Prioritise #1

Utilise the moment of light financial burdens and a long investment horizon. Plan ahead and start saving for retirement

Tip to Prioritise #2

Gain financial literacy - Learn what’s best and plan accordingly to get results

40s & 50s

Meet Robert

He’s 45, a teacher, married with 2 kids and earns over HKD$40,000 a month. Retirement is approaching and wants to get closer to the retirement goals. Looking to accelerate retirement savings.

Tip to Prioritise #1

Control and consider spending amounts, and increase the investment budget

Tip to Prioritise #2

Review MPF portfolio, adjust risk tolerance levels and consider new investment /saving streams

60+

Meet Mary

She’s 60, a senior executive, independent kids. Retirement is looming and she needs to ensure her retirement goals have been met or doing better than forecast.

Tip to Prioritise #1

Budget spending must be controlled and adjusted