[Many A Little Makes A Mickle]Increase Your Retirement Reserve With Voluntary MPF Contributions

Stocks and shares or bricks and mortar may be the universally-recognized “ways to wealth generation”, but for most of us who work a nine to six job, time is simply too scarce for us to keep up with the stock market day and night. Nor do we have sufficient savings to be used as investment principal. This calls for more flexible investment alternatives, such as making additional MPF contributions, to help increase investment returns.

This article will introduce three types of voluntary contributions under the MPF System, each with its own features that help you find the most suitable solution according to your financial situations. An early retirement is not impossible if you start making small steps in managing your budget, investing for your future savings, and reviewing your financial situations regularly.

Under the existing MPF System, mandatory contributions from an employer and an employee is capped at 5% of the employee’s salary, or a total of $3,000 per month. It may be insufficient to rely solely on mandatory contributions for a worry-free retirement.

Therefore, you may consider making additional voluntary contributions to increase personal savings, thus protection, for retirement purpose. Investing in funds through an MPF scheme has its own advantages, as MPF funds do not bear bid-ask spread, subscription or redemption fees. MFP fund expense ratio is also generally lower as compared to fees and charges of most retail funds. The average MFP fund expense ratio was 1.45% as of the end of January 2021^.

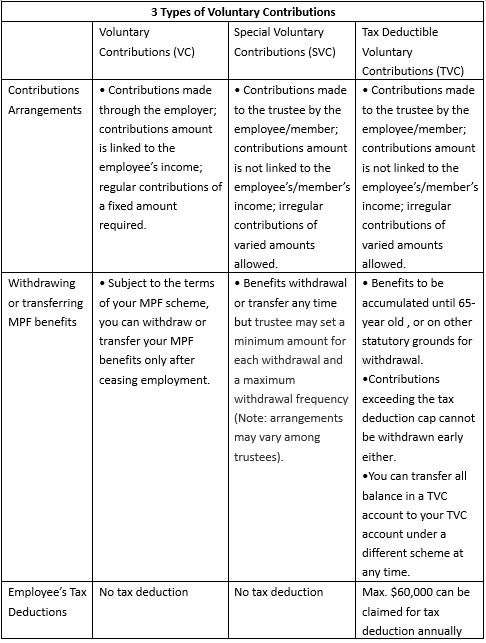

There are currently three types of voluntary contributions under the MPF System, namely Voluntary Contributions (VC), Special Voluntary Contributions (SVC) and Tax Deductible Voluntary Contributions (TVC). While all are categorized as additional contributions under the MPF System, they vary in terms of account set-up, contributions arrangements, withdrawal conditions and tax incentives, briefly summarized as below:

While all three types of voluntary contributions have their own features and advantages, you should choose the most suitable solution according to your personal needs, fund options, contributions arrangements and tax liabilities. For instance, young workers who just enter the workforce may opt for an SVC. By making a few hundred dollars of additional contributions every month, you can reinvest your returns, compounding your assets over time to snowball your retirement reserve. On the other hand, those with a higher salary approaching their retirement may opt for a TVC, where they can enjoy tax deduction benefits and increase savings for their retirement. Assume a couple each has a maximum of $60,000 to be claimed for tax deduction, with 17% tax rate, they can enjoy $20,400 of tax savings in total. The saved amount can then be added to their retirement reserve.

Compared to a case without TVC contributions, if you can keep up making $5,000 monthly TVC contributions (i.e. $60,000 annual TVC contributions), your gross account balance is expected to increase by 167%* in 20 years. To achieve a worry-free retirement, plan ahead and make additional MPF contributions in time to accumulate more wealth for the future.

*The calculated amount assumes the employer and the employee each makes a maximum of $1,500 monthly mandatory contributions, and the employee makes a monthly TVC contributions of $5,000, to be sustained for 20 years at 3% annualized return. For more information, please visit MPFA website

^Data can be found on MPFA website

Investment involves risks. This information is for general reference only.