Carefully manage your MPF with the right strategy to achieve your $1 million assets benchmark

Many are sloppy when it comes to managing their MPF, for it could take up a lot of time and patience. Most may also think a few hundred dollars of monthly contributions wouldn’t make much difference. According to the MPFA+, as of the end of 2019, more than 60,000 MPF accounts have accumulated over $1 million worth of assets!

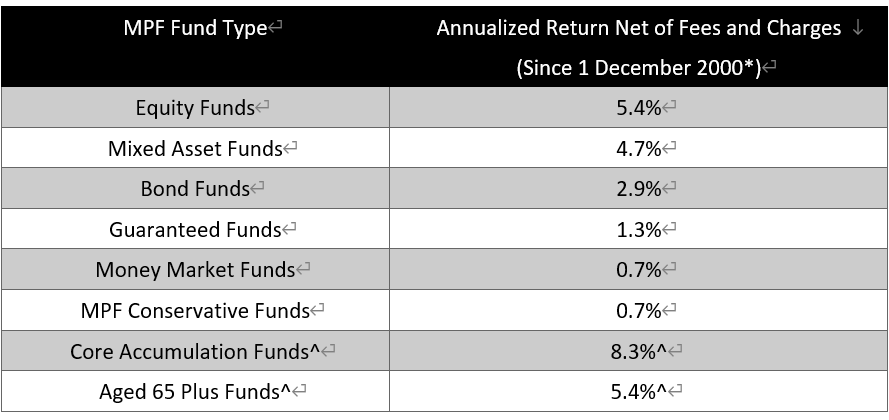

Assume an employee earns above $30,000 a month. With a monthly mandatory MPF contribution of $1,500 each from the employer and the employee, the employee’s account will have accumulated $36,000 in a year. Further assume a 4% annual rate of return, the MPF account will reach its $1 million benchmark in the 18th year. Choosing the right investment strategy is also critical. According to the MFPA~, from December 2000 to the end of 2020, equity funds registered an annualized return of 5.4%, while that of conservative funds and guaranteed funds were 0.7% and 1.3% respectively.

Assume your MPF yields around 6% of return annually, it will only take 16 years to achieve the $1 million benchmark. By contrast, if the annual return is 1.3%, it will take seven more years to reach such benchmark given the same amount of capital investment, meaning you will only have accumulated $1 million of assets in the 23rd year.

It is, however, important to note that equity funds generally bear higher risks. MPF scheme members should opt for the suitable portfolio taking into account factors such as their own risk appetite, or the stage of life they are in. Trying to capture or chase any short-term market trends may not be a wise way to go.

* Date of launch of the MPF System

^ Fund type in Default Investment Strategy (DIS), launched on 1 April, 2017

Furthermore, the MPFA once explained, in addition to mandatory contributions, many accounts receive voluntary contributions from both employers and employees, attributing to a significant addition in wealth in some of these accounts as compared to others. The government and some public institutions, for example, make more than 5% of contributions for their employees. Therefore, you may pay attention to whether your new employer provides such “staff benefits” next time you go job-hunting.

You can, alternatively, take the business into your own hands. Under the existing MPF structure, employees can make “voluntary contributions” such as Special Voluntary Contributions (SVC) and Tax Deductible Voluntary Contributions (TVC). An attractive feature of the SVC is, account holders can withdraw money any time before the age of 65. It also provides a higher degree of flexibility as you can set up an SVC account independent from your employer. TVC, on the other hand, provides tax deduction benefits capped at $60,000 – that is, $10,200 of tax can be saved given the tax rate is 17% or above. This scheme, however, sets a limitation in withdrawal – any withdrawal can only be made after the age of 65 (or on other statutory grounds).

MPF is an investment that spans over 20 to 30 years, so choosing the right types of funds makes a huge difference in compounding your wealth in the long run. Conservative funds, for instance, register less than 1% annualized return since its inception, while that of equity funds is roughly 5%. Whichever strategy you opt for, you should consider a range of factors including your risk appetite and retirement schedule. Together with good risk management and investment planning to capture higher potential growth would win you a greater chance of outperforming inflation in the long run.

Carefully manage your MPF with the right strategy helps a great deal in achieving your $1 million assets benchmark, leading to a wealthier, more secured life in retirement.

Source:

+: Statistical Analysis of Accrued Benefits Held by Scheme Members of Mandatory Provident Fund Schemes

~: MPFA announces 2020 MPF investment performance

Investment involves risks. This information is provided for general reference only.