Principal Global Equities

Our research indicates that investors often underestimate earnings potential as a company demonstrates positive fundamental change and that investors are inherently change and risk averse.

Core Beliefs

We believe markets are not perfectly efficient and that investors biases create exploitable anomalies. Our clear, consistent, and repeatable investment process seeks to identify and exploit these persistent anomalies through:

Focused stock selection

Capitalizing on the distinction between good investments and good companies.

Strategic portfolio construction

Embracing rewarded risk while isolating stock selection as the key driver of our results over time.

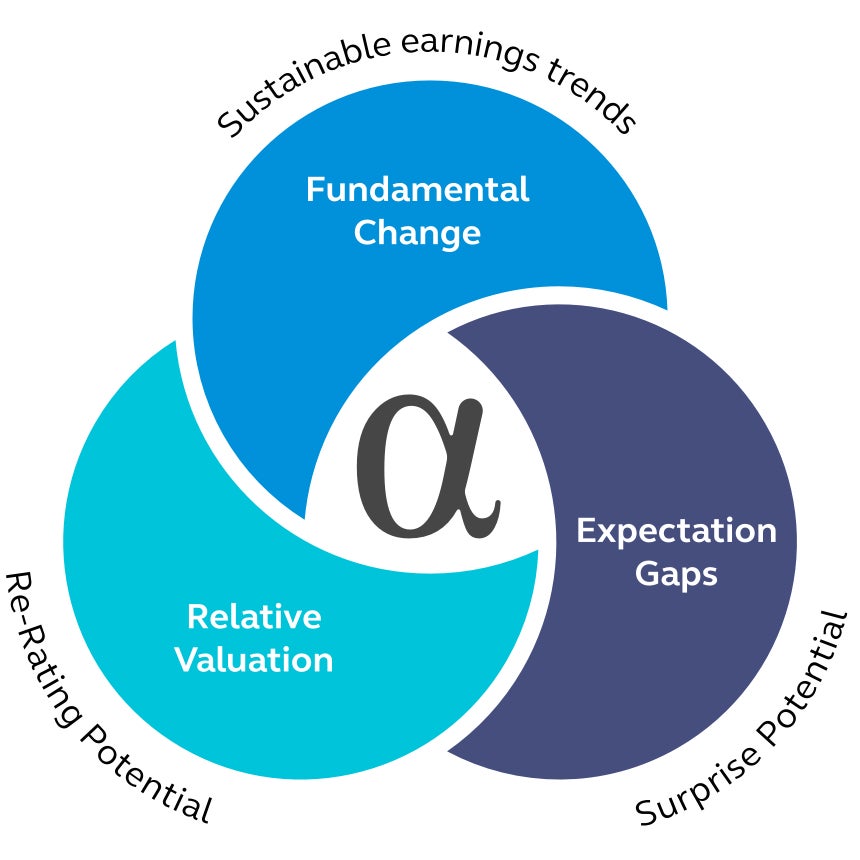

Three key characteristics essential to our approach

Years of research and experience indicate that companies demonstrating positive fundamental change, with exploitable expectation gaps, at attractive relative valuations are the most promising investment candidates. As such, every aspect of our stock selection discipline is focused on differentiating companies on the basis of these three key characteristics:

The Power of Fundamental Change – distinguishing good companies from good investments

We seek companies with improving and sustainable business fundamentals. This can be found in many forms, such as rising top-line growth, margin expansion, favorable product cycles, and industry trends. We’re particularly focused on identifying companies with accelerating and sustainable earnings and cash flow trends.

Our research analysts’ fundamental expertise is complemented by some of the best analytical tools in the industry, providing us a competitive advantage in identifying change in business conditions at an early stage. We scrutinize company operation performance, competitive position, capital deployment, and we engage company management to develop a complete assessment of each company we invest in. By evaluating the underlying business drivers of positive fundamental change, we’re able to assess both its sustainability and potential vulnerabilities.

Rising investor expectations – exploiting the expectations gap

This is where we incorporate the principles of behavioral finance. Once we’ve honed in on a company that is either showing potential for, or demonstrating fundamental change, we seek to understand the market’s expectation in order to identify surprise potential. We refer to the difference between the market’s expectation for a company’s earning potential and our estimate as the “expectations gap.”

Our research shows that the closing of this gap occurs slowly, and that this anomaly is persistent over time. Seeking to exploit the inherent biases of the sell side and other investors, we carefully analyze consensus expectations, disparate views, estimate revision trends, and rating changes. This research helps us find investment opportunities that offer the greatest potential for positive earnings surprise, while remaining keenly aware of movements that impact the gap.

Attractive relative valuation

Our research indicates that the performance potential of positive fundamental change is greatest when accompanied by discounted valuations, and is greatly diminished by valuation premiums. We seek companies with upward re-rating potential—meaning that they’re delivering earnings growth and earnings surprise. But, we don’t want to overpay, so we use valuation as our anchor to reality, ultimately investing in companies that offer opportunities for valuation and earnings multiples expansion and high cash flow return on investment relative to peers, history, and intrinsic risk premiums.

Principal Global Fixed Income

We believe the best returns are achieved through the integration of deep fundamental research, a global perspective, and disciplined risk management.

This philosophy is put into practice through a forward-looking, iterative investment process that revolves around these three key elements:

Macro/risk perspective

Integrated into the analysis of all our investment opportunities and their associated risks, this viewpoint is shared across teams in all sectors. Using our proprietary research framework, our investment professionals determine a dynamic risk score by identifying the key factors that are likely to drive investment performance.

Fundamentals, Technicals, Valuations (FTV) framework

This consistent, comparative framework, based on our independent internal research, is used throughout the investment process. Scalable and efficient, it helps us avoid emotional decision-making, facilitates communication, and provides guidance for sector allocation and security selection.

Dynamic risk management

We take a comprehensive, multi-dimensional approach to risk management. Our goal, supported by daily performance monitoring, is to provide you with a well-diversified portfolio that not only meets your investment objectives, but also provides the best risk-adjusted returns, while avoiding unnecessary or unplanned risk.

This material is intended for general reference only. This material does not constitute an offer or solicitation or invitation or advice or recommendation to enter into any transactions. Investment involves risk. There is no assurance on investment returns. You should consider your own risk tolerance level and financial circumstances before making any investment choices. If you are in doubt as to whether a certain fund or product mentioned in this material is suitable for you, you should seek independent professional advice.

Issuer of this material

Principal Global Investors Funds, CCB Principal Selected Growth Mixed Asset Fund, CCB Principal Dual Income Bond Fund

Issuer: Principal Investment & Retirement Services Limited

Principal Life Style Fund, Principal Prosperity Series

Issuer: Principal Asset Management Company (Asia) Limited

This material has not been reviewed by the Securities and Futures Commission.